The Future of Emerald Prices Predictions and Analysis

Evaluate the risks and rewards of investing in emeralds. Understand market volatility, sourcing challenges, and authentication issues.

Emerald Market Overview and Price Drivers

Okay, let's dive into the crystal ball and see what the future holds for emerald prices! The emerald market is a fascinating beast, influenced by a complex interplay of factors. Supply and demand, of course, are the biggies. But we also need to consider geopolitical stability in mining regions, evolving consumer preferences, and the ever-present specter of economic fluctuations.

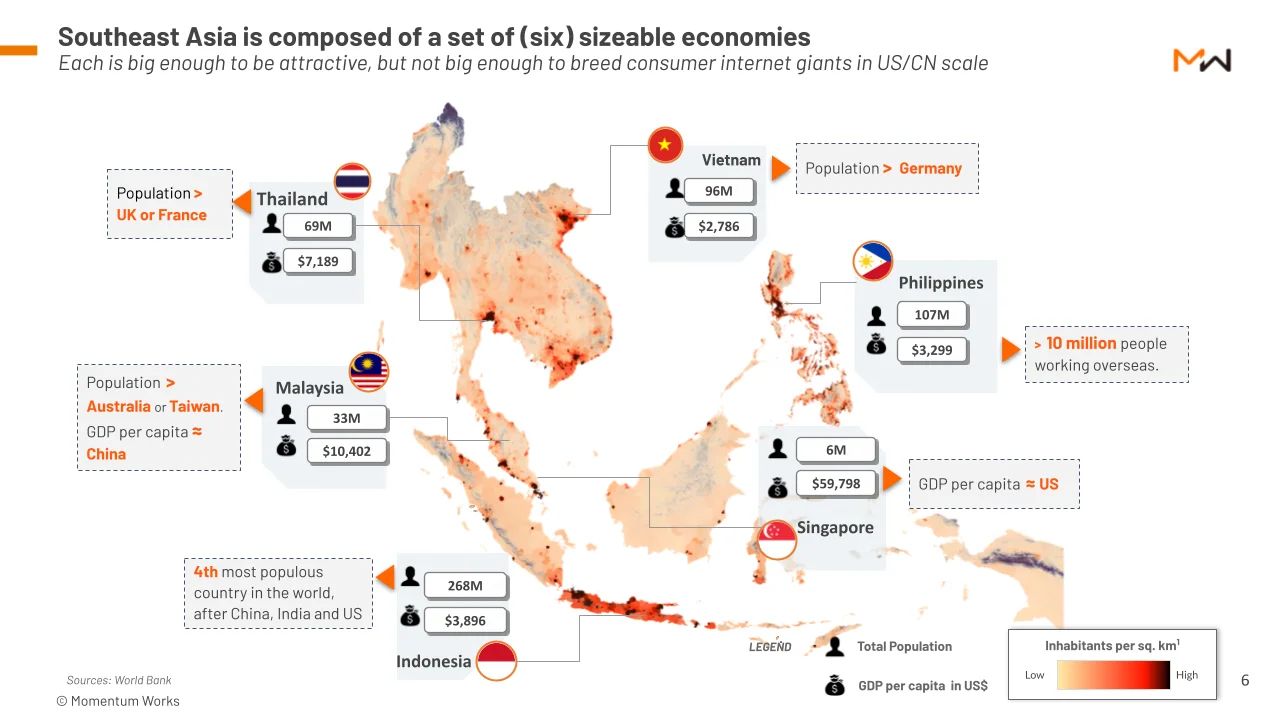

Right now, demand for high-quality emeralds is pretty solid, especially in the US and Southeast Asia. People are drawn to their vibrant green color and perceived rarity. However, supply can be a bit unpredictable. Major emerald-producing countries like Colombia, Zambia, and Brazil face their own challenges, from mining regulations to environmental concerns. Any disruption in supply can send prices soaring.

Economic trends also play a crucial role. In times of economic uncertainty, investors often flock to tangible assets like gemstones, which can drive up demand and prices. Conversely, during economic downturns, discretionary spending on luxury items like emeralds may decrease, putting downward pressure on prices.

Expert Predictions for Emerald Values

So, what are the experts saying? Well, opinions vary, as they always do! Some analysts predict a steady increase in emerald prices over the next few years, driven by increasing demand from emerging markets and limited supply of top-quality stones. They point to the growing popularity of colored gemstones as an alternative investment and the enduring appeal of emeralds as a symbol of luxury and sophistication.

Others are more cautious, citing the potential for price volatility due to economic uncertainty and the risk of oversupply if new emerald deposits are discovered. They emphasize the importance of careful due diligence and selecting emeralds with impeccable provenance and quality.

Ultimately, the future of emerald prices depends on a complex interplay of factors, and no one can predict the future with certainty. However, by understanding the key drivers of the market and following expert analysis, investors can make informed decisions and potentially profit from the enduring allure of emeralds.

Analyzing Supply Chain Dynamics and Their Impact on Emerald Prices

The journey of an emerald from the mine to a jewelry store is a long and winding one, and each step in the supply chain can impact its final price. Let's take a closer look:

- Mining: The cost of mining emeralds can vary greatly depending on the location, mining techniques, and environmental regulations. Mines that employ sustainable and ethical practices may incur higher costs, which can translate into higher prices for their emeralds.

- Cutting and Polishing: The skill of the cutter can significantly impact the beauty and value of an emerald. A well-cut emerald will maximize its brilliance and color, while a poorly cut emerald may appear dull and lifeless.

- Distribution: Emeralds typically pass through several intermediaries before reaching retailers, including wholesalers, dealers, and gemological labs. Each intermediary adds their own markup, which contributes to the final price.

- Retail: Retailers add their own markup to cover their operating costs and generate a profit. The markup can vary depending on the retailer's brand, location, and marketing strategy.

Understanding the dynamics of the emerald supply chain can help investors make more informed decisions and potentially identify opportunities to buy emeralds at more competitive prices. For example, buying directly from a reputable miner or wholesaler may allow you to bypass some of the intermediaries and save money.

Specific Emerald Products to Consider

Alright, let's talk specifics! Here are a few emerald products that might be worth considering, along with some usage scenarios and price ranges (remember, prices can fluctuate!):

- Colombian Emerald Ring (1.5 Carat, Classic Cut): This is a timeless piece, perfect for everyday wear or special occasions. Look for a ring with a classic design and a vibrant green emerald with good clarity. Usage Scenario: Engagement ring, anniversary gift, or a treat for yourself! Price Range: $8,000 - $15,000

- Zambian Emerald Pendant (2 Carat, Pear Shape): A stunning pendant can add a touch of elegance to any outfit. Zambian emeralds often have a slightly bluish-green hue, which is highly sought after. Usage Scenario: Formal events, date nights, or a statement piece for your jewelry collection. Price Range: $6,000 - $12,000

- Emerald and Diamond Earrings (0.75 Carat Emeralds, Round Cut): These earrings offer a beautiful combination of color and sparkle. The diamonds enhance the emeralds' brilliance and add a touch of luxury. Usage Scenario: Weddings, parties, or a special gift for a loved one. Price Range: $4,000 - $8,000

Comparing Emerald Brands and Quality

When buying emeralds, it's important to consider the brand and quality of the gemstone. Here's a quick comparison of some popular emerald brands:

- Chivor Emeralds (Colombia): Known for their intense green color and exceptional clarity. Often considered the highest quality emeralds in the world.

- Muzo Emeralds (Colombia): Another renowned Colombian emerald brand, known for their slightly bluish-green hue and excellent brilliance.

- Gemfields Emeralds (Zambia): A leading Zambian emerald producer, known for their commitment to ethical and sustainable mining practices. Their emeralds often have a slightly yellowish-green hue.

Quality is determined by the 'Four Cs':

- Color: The most important factor. Look for a vibrant, saturated green color.

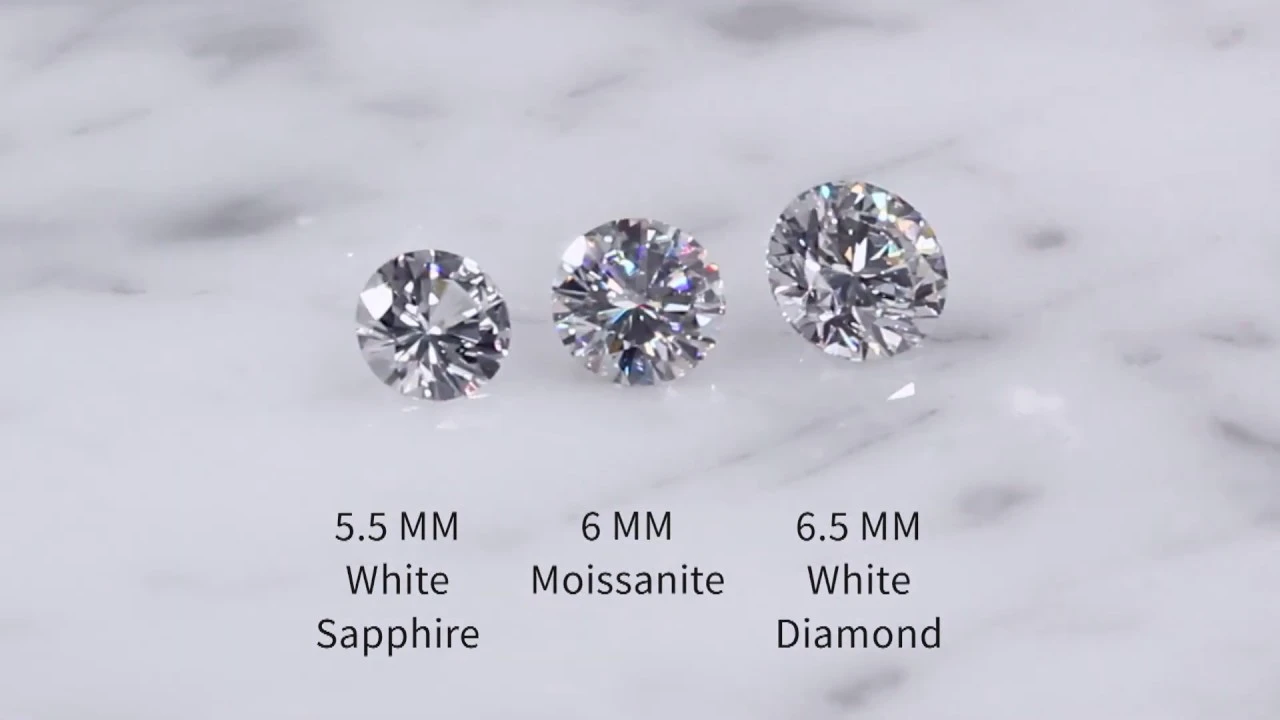

- Clarity: Emeralds often have inclusions (internal flaws), but try to find one with minimal inclusions that don't detract from its beauty.

- Cut: A well-cut emerald will maximize its brilliance and color.

- Carat: The size of the emerald, measured in carats. Larger emeralds are generally more valuable.

Navigating Emerald Authentication and Avoiding Scams

Unfortunately, the gemstone market is not immune to scams. It's crucial to be vigilant and take steps to protect yourself from fraud. Here are some tips:

- Buy from reputable dealers: Stick to established jewelers and gemstone dealers with a proven track record.

- Get a gemological certificate: A certificate from a reputable gemological lab (like GIA or AGL) can verify the authenticity and quality of the emerald.

- Be wary of unusually low prices: If a deal seems too good to be true, it probably is.

- Inspect the emerald carefully: Use a loupe to examine the emerald for any signs of treatment or enhancement.

- Trust your instincts: If something feels off, don't hesitate to walk away.

By following these tips, you can increase your chances of buying a genuine and valuable emerald and avoid falling victim to scams.

The Impact of Economic Factors on Emerald Investment

As mentioned earlier, economic factors can significantly influence the emerald market. Here's a closer look at some key economic considerations:

- Inflation: During periods of high inflation, investors often seek out tangible assets like gemstones as a hedge against currency devaluation. This can drive up demand and prices for emeralds.

- Interest Rates: Higher interest rates can make it more expensive to borrow money, which can dampen demand for luxury items like emeralds.

- Economic Growth: Strong economic growth typically leads to increased consumer spending and a greater demand for luxury goods, including emeralds.

- Currency Fluctuations: Changes in currency exchange rates can impact the prices of emeralds, especially for international investors.

Staying informed about economic trends and understanding their potential impact on the emerald market is essential for making sound investment decisions.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)