Emerald Investment Risks and How to Mitigate Them US & Southeast Asia

Emerald Investment Risks and How to Mitigate Them US & Southeast Asia

Understanding the Emerald Market in the US and Southeast Asia

Alright, let's talk about emeralds. These green beauties are tempting, right? But before you dive headfirst into the emerald market, especially in the US and Southeast Asia, let's get real about the risks. We're talking about protecting your hard-earned cash, so listen up!

The Allure of Emeralds Investment Potential

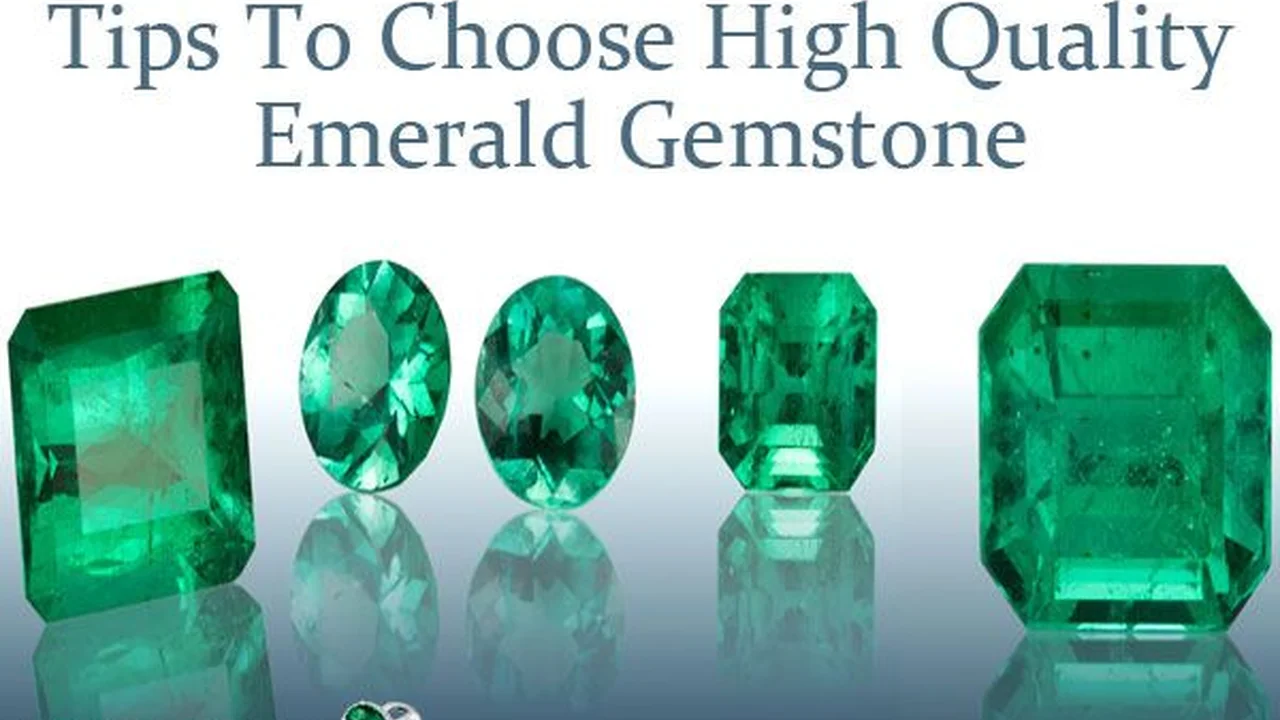

Emeralds have that undeniable 'wow' factor. Their vibrant green hue, often compared to lush forests, has captivated people for centuries. From Cleopatra's legendary collection to modern-day high-end jewelry, emeralds hold a special place in the world of gemstones. This enduring appeal translates into investment potential, particularly in markets like the US and Southeast Asia, where demand for colored gemstones is steadily growing. But it's not all sunshine and rainbows, so we need to examine the risks.

Risk #1: Authenticity A Sea of Synthetics and Treatments

This is a big one. The market is flooded with synthetic emeralds and heavily treated natural stones. Telling the difference between a genuine, high-quality emerald and a cleverly disguised fake can be tricky.

Mitigation:

- Certification is Key: ALWAYS, ALWAYS, ALWAYS get your emerald certified by a reputable gemological lab like GIA (Gemological Institute of America), AGS (American Gem Society), or Gübelin. These labs will thoroughly examine the stone and provide a report detailing its origin (if possible), treatments, and overall quality.

- Trust Your Source: Buy from reputable dealers with a proven track record. Look for jewelers who are transparent about their sourcing and are willing to provide detailed information about the emeralds they sell. Established businesses often have a vested interest in maintaining their reputation.

- Learn the Tell-Tale Signs: Educate yourself about the characteristics of natural emeralds versus synthetics. Natural emeralds often have inclusions (internal imperfections) that, while sometimes detracting from clarity, can actually be a sign of authenticity. Synthetics, on the other hand, tend to be flawless.

Risk #2: Clarity Enhancements The Treatment Tango

Most emeralds undergo some form of treatment to improve their clarity. This usually involves filling surface-reaching fractures with oils or resins. While these treatments can enhance the stone's appearance, they can also be unstable and degrade over time, affecting the emerald's value.

Mitigation:

- Ask About Treatments: Always ask your jeweler about any treatments the emerald has undergone. Reputable dealers will be upfront about this.

- Understand the Treatment Type: Different treatments have different levels of stability. Opt for emeralds treated with stable, durable substances. Avoid stones treated with temporary fillers that are likely to degrade quickly.

- Consider Untreated Emeralds: While rare and expensive, untreated emeralds are the most valuable and stable investment. If your budget allows, focus on finding a high-quality, untreated stone.

Risk #3: Origin and Ethical Concerns The Minefield of Mining

The origin of an emerald can significantly impact its value. Colombian emeralds, particularly those from Muzo and Chivor, are highly prized for their exceptional color and quality. However, some emerald mines are associated with unethical labor practices and environmental damage.

Mitigation:

- Traceability is Important: Inquire about the emerald's origin and the mining practices used to extract it. Look for jewelers who support ethical and sustainable mining practices.

- Consider Canadian Emeralds: While less well-known than Colombian emeralds, Canadian emeralds are mined under strict environmental and labor regulations, making them a more ethical choice.

- Support Responsible Sourcing Initiatives: Look for jewelers who are members of organizations like the Responsible Jewellery Council (RJC), which promotes ethical and responsible practices throughout the jewelry supply chain.

Risk #4: Market Fluctuations Riding the Rollercoaster

Like any investment, the value of emeralds can fluctuate based on market demand, economic conditions, and fashion trends. What's hot today might not be tomorrow.

Mitigation:

- Diversify Your Portfolio: Don't put all your eggs in one basket. Invest in a variety of assets, including other gemstones, stocks, bonds, and real estate.

- Do Your Research: Stay informed about market trends and factors that can influence emerald prices. Read industry publications, attend gem and jewelry shows, and consult with experienced gemstone investors.

- Think Long-Term: Emeralds are generally considered a long-term investment. Don't expect to get rich quick. Be patient and hold onto your emeralds for several years to allow their value to appreciate.

Risk #5: Liquidity Turning Green into Greenbacks

Unlike stocks or bonds, emeralds are not easily liquidated. Selling an emerald can take time and effort, and you might not get the price you're hoping for.

Mitigation:

- Plan Your Exit Strategy: Before you buy an emerald, consider how you will sell it when the time comes. Will you sell it through a jeweler, an auction house, or a private sale?

- Build Relationships: Develop relationships with reputable jewelers and gemstone dealers who can help you sell your emerald when you're ready.

- Be Realistic About Pricing: Don't expect to sell your emerald for more than it's worth. Be prepared to negotiate and accept a fair price.

Emerald Product Examples and Scenarios for US & Southeast Asia

Okay, let's look at some specific examples of emeralds and how they might fit into your investment strategy, considering both the US and Southeast Asian markets.

Example 1: Colombian Emerald Ring

Description: A 2-carat, vivid green Colombian emerald, certified by GIA, set in a platinum ring with small diamond accents. The emerald has minor oil treatment.

Scenario: This ring would be appealing to high-net-worth individuals in both the US and Southeast Asia who appreciate classic jewelry and are looking for a statement piece.

Price Range: $15,000 - $25,000

Risk Mitigation: The GIA certification verifies the emerald's authenticity and origin. The minor oil treatment is acceptable, but it's important to monitor the stone for any signs of degradation over time.

Example 2: Zambian Emerald Pendant

Description: A 3-carat, slightly bluish-green Zambian emerald, certified by a reputable lab, set in a white gold pendant with a modern design. The emerald has moderate clarity enhancement.

Scenario: This pendant could be attractive to a younger demographic in Southeast Asia who appreciate contemporary jewelry and are looking for a more affordable emerald option.

Price Range: $8,000 - $12,000

Risk Mitigation: While Zambian emeralds are generally less expensive than Colombian emeralds, it's crucial to ensure the clarity enhancement is stable. Monitor the stone closely for any changes in appearance.

Example 3: Emerald Beads Necklace

Description: A strand of small, natural emerald beads, untreated, with varying shades of green. The beads are strung on a silk cord with a gold clasp.

Scenario: This necklace would appeal to consumers in both the US and Southeast Asia who appreciate natural, organic jewelry and are looking for a versatile piece that can be worn casually or dressed up.

Price Range: $5,000 - $8,000

Risk Mitigation: The fact that the emeralds are untreated is a major selling point. However, it's important to inspect the beads carefully for any cracks or chips.

Comparative Analysis: Emerald Jewelry

Let's compare these three options:

- Colombian Emerald Ring: Highest price, classic design, strong investment potential due to origin and certification. Best for long-term investors seeking a high-value asset.

- Zambian Emerald Pendant: Mid-range price, modern design, good for a younger demographic. Requires careful monitoring of clarity enhancement.

- Emerald Beads Necklace: Lowest price, natural and versatile, appealing to a wider audience. Good for those seeking a wearable investment piece.

When choosing an emerald investment, consider your budget, risk tolerance, and investment goals. Also, think about the target market. What styles and colors are currently trending in the US and Southeast Asia? Do your research and make informed decisions.

Final Thoughts Emeralds: A Rewarding Investment with Careful Consideration

Investing in emeralds can be a rewarding experience, but it's essential to approach it with caution and awareness. By understanding the risks and implementing the mitigation strategies outlined above, you can protect your investment and potentially profit from the enduring beauty and value of these captivating gemstones. Remember, knowledge is power, and a well-informed investor is a successful investor. Good luck!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)